A guide to Professional Liability insurance

If your business provides professional advice or services to clients, you may have heard that you should have professional liability insurance to protect your company financially. What is professional liability insurance coverage? What does professional liability insurance cover? And what does professional liability insurance cost?

Before you buy a policy, you’ll want answers to these questions. This guide provides information to help you understand the concept of professional liability insurance, why it’s important, and more.

We’ll start by describing this important coverage.

What is Professional Liability insurance?

Small business professional liability insurance protects individuals or companies that provide professional advice. In this context, “professional” means people like accountants, lawyers, and others who have specialized knowledge and training in a particular area and are expected to meet specific standards. "Liability" means being responsible—typically by law—for the consequences of your actions.

So, professional liability coverage is designed to protect people who provide expert advice or services and are sued by clients over something that caused the client a financial loss—whether the policyholder did what they are accused of or not.

What does Professional Liability insurance cover?

Business owners sometimes ask us, “What does professional liability insurance cover?" Professional liability insurance, also called errors and omissions insurance or just E&O, provides coverage for three main types of claims:

So, it’s clear that it makes sense to have a good level of professional liability coverage. Of course, these are just examples, and there are many causes of professional liability lawsuits. Still, the result is the same: If a court finds you liable, your business can be required to compensate a client financially. If you don’t have professional liability insurance, your company has to pay that compensation directly.

The cost of a single incident can create a huge expense for an uninsured or inadequately insured company. Unfortunately, the amount can be so large it drives the business out of business. That’s why having professional liability insurance is so important.

What isn’t covered by Professional Liability insurance?

Professional liability insurance provides critical financial protection and covers many types of errors and omissions—actual or alleged. But like any type of small business insurance, a professional insurance liability policy has exclusions.

For example, it won’t protect your business if you commit fraud or other criminal acts. A professional insurance liability policy also won’t cover things that aren’t crimes but are intentional actions or intentional delays in performing required activities. In other words, professional liability insurance is designed to help protect you when you’ve made honest mistakes.

Coverage is also limited to your professional advice or services. Other policies cover different types of incidents. For example:

- Workers’ compensation insurance covers employee on-the-job injuries, illnesses, or fatalities.

- A business owners policy (BOP) or general liability insurance can cover injuries to non-employees at your location—like when a visiting client or delivery person slips and falls on a wet floor at your office. A BOP can also cover damage to company property.

- Commercial auto insurance covers liability and vehicle damage resulting from your employee being at fault in an accident while driving a company-owned or leased vehicle.

- Cyber insurance, which you purchase as an add-on to a BOP, general liability, or professional liability policy, provides protection from the financial fallout if someone steals sensitive data from you.

A licensed biBerk insurance expert can talk with you about your business and help you understand which parts of your operation professional liability insurance can and can’t cover. For example, common questions that get asked are, “What is professional liability insurance?”, "What’s the difference between general liability and professional liability?", and “What does professional liability insurance cost?”

Who needs Professional Liability insurance?

In general, anyone who provides professional advice or services probably needs professional liability insurance. That broad description covers many specific business specialties and roles, including:

- Accountants

- Advertising consultants

- Answering services

- Architects and engineers

- Audio/visual consultants

- Barbers and beauticians

- Billing services

- Bookkeepers

- Business management consultants

- Certified financial analysts

- Claim administrators

- Communications/media/public relations consultants

- Compensation and benefits consultants

- Corporate trainers

- Educational consultants

- Executive coaching consultants

- Funeral directors

- Graphic designers

- Home inspectors

- Image consultants

- Insurance agents

- Interior designers/decorators

- IT consultants

- Journalists/broadcasters

- Landscape architects

- Loss control inspectors

- Market research consultants

- Notaries

- Optical and hearing aid professionals

- Personal trainers

- Photographers

- Printers

- Procurement consultants

- Project management consultants

- Real estate agents and brokers

- Recruiting consultants

- Sales and marketing consultants

- Security guards

- Social workers

- Software companies

- Strategic planning consultants

- Training and development consultants

- Travel agents

- Tutors

These are just examples. If you don’t see your type of business on this list, that doesn’t mean you wouldn’t benefit from professional liability insurance. You should contact a biBerk representative to talk about your company and your business insurance needs.

If you assume you don’t need a policy when you actually do, and an incident occurs, you can end up with a large out-of-pocket legal expense.

Am I required to have Professional Liability insurance coverage?

States dictate whether certain professions are required to have professional liability insurance and/or disclose whether they carry coverage. So, you’ll need to get familiar with the regulations for your industry and location. biBerk licensed insurance experts can provide guidance.

Beyond state requirements, your clients might require you to have professional liability insurance. Often, contracts will include clauses regarding insurance coverage.

Who turns to biBerk for Professional Liability insurance?

We help many types of business professionals assess their liability risks and get the insurance they need.

Small business owners

Even the most diligent owners make mistakes. Worrying about the financial impact of alleged errors, omissions, and negligence can weigh you down. But if you have professional liability insurance, you can stay focused on doing great work and growing your business since you know lawsuits don’t have to create huge financial burdens. Business owners look to biBerk for insights on how to assess their risks and get the coverage they need to address them. Our licensed insurance experts have experience with businesses in a wide range of industries to draw from.

Managers and other decision-makers

Busy business owners sometimes delegate decisions about their insurance and compliance requirements to others in the company. These people appreciate our guidance on why the business needs professional liability insurance and how much coverage is enough based on the risks faced. Our team can provide real-world examples of how other similar businesses protect themselves from lawsuits to help managers and decision-makers reach well-informed conclusions about their insurance strategy.

Freelance professionals

Freelancers understand that any client engagement has the potential for disagreements and lawsuits. That’s an unfortunate reality in the professional services industry. The good news is that professional liability insurance can help protect their livelihoods. Being adequately insured also gives their clients confidence, and positive word of mouth is great advertising. Freelancers who turn to biBerk for coverage appreciate that we make professional liability and other policies easy to understand and simple to buy.

Professional Liability insurance, legal defense costs, and punitive damages

If a client sues you over a covered professional liability issue, your biBerk professional liability policy can pay for your legal defense. It can also cover any damages (including punitive damages, if permitted by law in your state) the court awards to the plaintiff. In addition, we provide an attorney to represent you, which can help relieve some of the anxiety in a very stressful situation.

Our covering of punitive damages is vital since the dollar figures can be very high. Courts assess punitive damages on top of other damages to punish companies they find to be at fault. If your state allows these damages to be covered by a professional liability insurance policy, biBerk can cover you up to the policy limit.

What does Professional Liability insurance cost?

One of the first questions we get from business owners is, “What does professional liability insurance cost?” We understand why that’s at the top of the list!

Professional liability insurance costs are very reasonable when you consider the protection provided. biBerk professional liability policies start at around $300 per year and go up from there. Your cost is calculated based on several factors, including your industry, the level of coverage you choose, your years in business, number of employees, revenue, and the policy limits you need.

You can get an instant, self-service online quote to learn what you’ll pay for this vital coverage. But, if you have additional questions about how much professional liability insurance costs or need help purchasing a policy, a biBerk representative is happy to assist you.

How can I keep my Professional Liability insurance cost down?

biBerk’s professional liability insurance policies are among the most affordable on the market. Our direct-to-you approach means we cut out brokers and middlemen to offer you coverage at up to 20% less than other companies.

Still, there are a few steps you can take to ensure you’re getting great insurance at the lowest price. For starters, you should purchase the right amount of coverage. The more financial protection you want, the higher your premiums will be. For example, all else being equal, $500,000 in coverage will cost less than $2 million in coverage.

You can also select a higher deductible. As with auto insurance, higher deductibles mean lower premiums. Just remember that you have to have that deductible amount available at all times in the event of a claim. Ultimately, it’s about finding the right balance between your needs and your budget.

In addition, you can keep your professional liability costs down by having a Statement of Work, contract, or other document executed by you and your client that clearly spells out expectations, timelines, etc. That way, there’s no confusion about what the project or relationship entails and less risk of a lawsuit. If you can have an attorney review the agreement, that’s even better.

Understanding Professional Liability insurance retroactive dates

Professional liability insurance is kind of unique in that it can have what’s called a retroactive date. This date means that your policy can cover costs associated with claims that clients file after your coverage is in force for issues that occurred before you bought your current policy.

Here's an example:

Your professional liability policy began on June 30, with a retroactive date of January 1. In mid-July, a former client claims you made a mistake in March when working on their tax return. Both you and the client were unaware of this issue when you bought your policy as it didn’t come to light until July. Since the occurrence causing the claim took place during the retroactive coverage period (between January 1 and June 29), and you made the claim during your regular coverage period, your policy will likely cover it.

When you buy your first professional liability policy, you don’t receive coverage for prior acts. However, you build this coverage over time as you continually purchase new coverage. The first policy only covers acts that both occurred and were reported during the first year. The second policy covers acts that occurred during the first two years and reported during the second year, and so on.

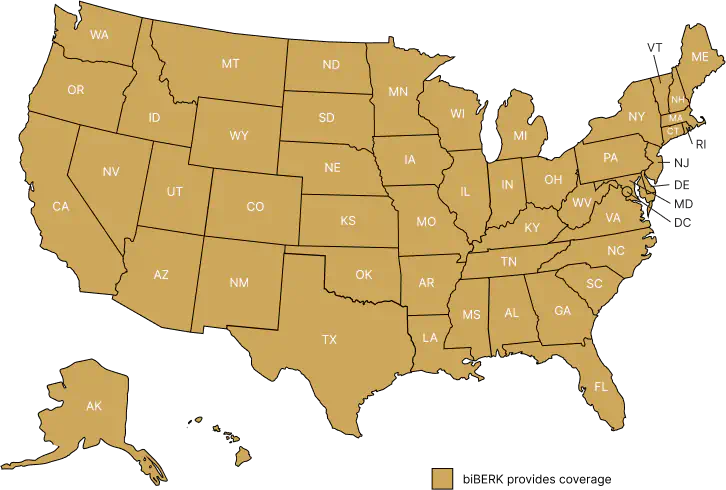

Does biBerk offer Professional Liability Insurance in my state?

biBerk offers professional liability insurance in all U.S. states. If you have questions about whether you can purchase other types of small business insurance where you are, our coverage maps make it easy to check availability.

Keep in mind that factors like your business type, claims history, and others affect our ability to offer you insurance coverage, even if it’s technically available in your state.

How to prove you have Professional Liability insurance

A Certificate of Insurance (COI) is a physical or digital document that states you’ve purchased insurance and summarizes your coverage. Individuals and organizations you have business relationships with might ask you to provide them with COIs. They do this because the fact that you have insurance lowers their risk if a lawsuit related to your professional services occurs.

You can get these documents easily and at no cost on the biBerk website. If you need to add what’s called an additional insured (meaning someone, like a client, who may be covered by your policy), our representatives can help you with that.

An example of Professional Liability insurance in action

How does professional liability insurance work? Imagine you’re an architect, and you design a bridge for a local municipality. A construction company builds the bridge according to your blueprints, and initially, it looks fine.

But after a few months, parts of the bridge show signs of deterioration. Then, before the city can do anything, a section of the bridge collapses. Fortunately, no one is hurt, but a subsequent review of your blueprints shows that an error you made in your calculations caused the bridge to fail.

The city sues your firm for several expenses incurred due to your faulty design. These costs include commissioning a new design, paying to have the bridge rebuilt, etc. And this is a very simplified scenario, of course. Professional liability litigation frequently involves multiple parties, contractors and subcontractors, suits and countersuits. In other words, the cost of an honest mistake can be very high.

The good news is that if you have enough professional liability coverage, your policy can protect you from the financial fallout of this type of event. Just report the claim, and our team will contact you and go to work on your behalf.

Even if no one ever sues you, simply knowing that biBerk has your back can lower your stress level and let you do your job confidently and without continually second-guessing your work.

Frequently asked questions about Professional Liability insurance

Who needs professional liability insurance?

What is professional liability insurance and who needs it? Professionals who work in certain sectors or industries should get a comprehensive professional liability insurance policy. It’s a core business requirement for some professions—particularly those people who might be more likely to have service-based disputes.

It’s a priority if your business provides any form of professional services, such as advice and consultancy, to clients. It’s also a must-have if you’re in a line of work that means you’re more open to disputes over quality of work or copyright (if you’re a designer, for instance).

You should consider a professional liability policy if you’re more at risk of being sued for professional negligence, including if you’re a freelance worker or provide any services on a self-employed basis.

People who work in sectors such as healthcare are also likely to need professional indemnity insurance (like medical malpractice insurance) because they work with specific industry bodies that set rules and regulations that must be adhered to.

Basically, if there’s a chance a client could take you to court over a professional advice or services dispute that has adversely affected them, then taking out a professional liability coverage policy is a good idea. If you’re still not sure whether you need one, talk with one of our licensed insurance experts. They can give you accurate advice on what you need (and what you don’t need).

How much small business professional liability insurance do I need?

It sounds a little vague, but you should take out as much as you can afford, once you’ve spoken to an insurance advisor and worked out what you might need. This type of insurance policy isn’t a one-size-fits-all type of coverage. Every business and every worker is different, so their needs for insurance will also be unique.

Consequently, it’s difficult to predict how much professional liability insurance cover anyone will need. You should start by thinking about the following: What do you do? Who do you do it for? What are your services worth? If you can provide us with detailed answers to these questions, it can help us advise you on how much coverage you need and what it will cost.

Is professional liability insurance required?

It very much depends on the type of services you or your business offer, and it’s worth talking to a biBerk professional insurance advisor if you’re not sure. Check your state laws, rules, and regulations, and get advice from one of our experts.

How does professional liability insurance work?

Professional liability insurance helps protect you against claims for loss or damage made by clients in the event you’ve given incorrect advice or provided a service to them that fails to meet accepted standards. Your policy can pay for court-awarded damages and your legal defense expenses.

What does professional liability insurance not cover?

Professional liability insurance policies often have exclusions and it’s worth knowing what these are before you take a policy out. For instance, if your business has committed fraud or any other form of criminal activity, professional liability insurance won’t cover you. It also won’t cover intentional actions or intentional delays in performing required activities or services for a client. So, to put it in its simplest terms, professional liability insurance will only protect you when you’ve made honest errors and mistakes.

Getting and managing a Professional Liability insurance policy is easy.

Professional liability insurance can protect your business from complicated legal actions, but getting the coverage is simple. You can get a quote and purchase a policy online whenever it’s convenient. You can also manage your policy on our website, and if you ever have to report a claim, you can do that online, too.

Once your policy is in force, you can rest easy knowing you have the financial strength of biBerk and the Berkshire Hathaway Insurance Group behind you.